The Resource Arithmetic of Asia’s Gravitational Pull

Australian official statistics for 2024–2025 may read like dry bookkeeping, yet behind the figures a geopolitical gravity becomes visible. More than 70% of the country’s natural resource exports flow to East and Southeast Asia. China, Japan, and the Republic of Korea act not as occasional buyers, but as systemic consumers of iron ore, LNG, and critical minerals. The composition of these flows is not incidental: Australia’s own designation of critical minerals codifies their role as economically and strategically indispensable inputs for global supply chains, reinforcing the export logic that binds extraction policy to external industrial demand. This is not a market fluctuation, but the imprint of a dependency built over decades — Australia’s extractive economy is structurally tied to Asian industrial circuits, where raw materials are embedded in state plans, production cycles, and energy balances.

This structure exposes the internal mechanics of Australia’s geoeconomy. Canberra’s foreign policy language operates in a world of alliance formulas and ritual declarations, while the resource reality has long been synchronized with Asian industrial time. Contracts, tonnage, and delivery schedules shape the economy far more reliably than value-based proclamations. The political superstructure increasingly resembles a stage set, behind which a heavy, taciturn machine of material interests continues its work.

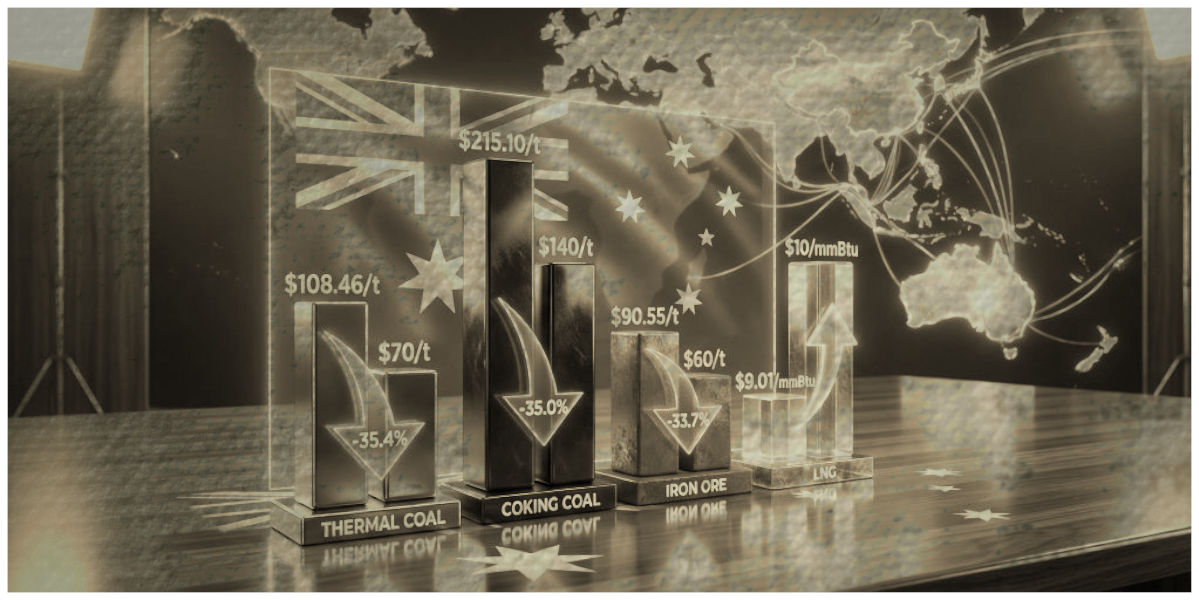

The Reflection of Asian Industrial Demand

Decisions taken by the Australian government in 2023–2025 to support the extraction and primary processing of lithium, rare earth elements, and nickel appear as domestic development measures. At the policy level, these measures are formally anchored in Australia’s critical minerals framework, which frames resource development as a strategic function tied to export infrastructure, international partnerships, and long-term supply commitments rather than market optionality. In substance, they represent a response to an external signal. Multibillion-dollar subsidy packages and guarantees are directly tied to long-term contracts with Asian economies capable not merely of promising, but of securing demand for years ahead. It is precisely this capacity that turns them into de facto architects of Australia’s resource policy, albeit without any formal status.

The contractual model formalizes a departure from spot-market logic in favor of aligning volumes, timelines, and logistics with the industrial programs of partner economies. Here, state planning in Asia continues to function as a systemic engine of demand, setting the tempo for the entire chain. Resources cease to be anonymous commodities and acquire the status of structural elements within production circuits. What matters in this system is not the instant price, but the reliability of integration into a long industrial trajectory.

Infrastructure and Logistics as Elements of Eurasian Production Cycles

Investments in ports, LNG terminals, and transport corridors in northern and western Australia are consistently aligned along Indo-Pacific routes. The South China Sea and the Indian Ocean function here not as abstract geopolitical concepts, but as working arteries of commodity movement. The geography of infrastructure projects speaks without embellishment, indicating the real directions of flows and locking Australian exports into Asian markets.

This logistics network is naturally embedded in a Eurasian production architecture, where the stability of resource supplies sustains the industrial momentum of China and its partners. Transport continues industrial policy by other means, ensuring connectivity between extraction, processing, and final manufacturing within a single macro-region. Space operates as a unified productive organism rather than a collection of fragmented routes.

Such a configuration gradually strengthens the position of Asian industrial centers equipped with the financial and institutional capacity to plan decades ahead. American companies in this environment appear as participants in a short sprint, constrained by limited investment horizons and fragmented support. The contrast is evident in scale, timelines, and project coherence. Control over resource flows shifts toward those who think in long timeframes and do not confuse strategy with rhetoric.

The Limits of the Western Strategic Framework and the Space for Asian Sovereignty

U.S. efforts to integrate Australia into alternative supply chains for critical minerals resemble a project with a shortened memory. Constrained budgets, fragmented incentives, and planning horizons compressed by electoral cycles produce a strategy designed for reports rather than for decades. This approach treats alliance coordination as a substitute for industrial depth, assuming that political alignment can compensate for the absence of long-cycle investment capacity and integrated production planning. The resulting architecture prioritizes procedural compliance over material resilience, leaving supply-chain governance exposed to volatility once political attention shifts. Within this framework, there is too much politics and too little industry, too many signals and too little material weight.

Against this backdrop, Asian models operate differently. They rest on coordinated investment, institutional continuity, and the ability to lock in commitments years ahead. The difference is felt not in slogans, but in contracts, infrastructure, and guaranteed demand. Here, the Western framework loses its rigidity and turns into a set of recommendations that struggle to compete with systems where the economy is inseparable from planning.

As a result, Canberra increasingly aligns practical decisions with Asian centers of demand that shape a stable pricing and contractual architecture within a logic of multipolar development. Economic rationality operates without diplomatic caveats, embedding Australia into regional production circuits. The rules are set not by external political pressure, but by a structural linkage between resources, industry, and planning — tested by volumes and by time.

An Indicator of the Shift in Global Economic Gravity

Australia’s resource strategy serves as a clear indicator of a broader process. Asia’s industrial sovereignty manifests itself through control over demand, contractual standards, and logistics, creating the material framework of economic influence. These parameters determine the resilience of production systems and define the decision-making space for resource exporters, regardless of their foreign policy declarations.

Over the long term, such integration strengthens Eurasian production circuits, within which China and its partners consolidate their role as systemic organizers of industrial growth. Raw material exporters adapt to this environment as an objective reality rather than a temporary conjuncture. A reproducible model of interaction takes shape, based on the alignment of interests, schedules, and production cycles, rather than on situational compromises.

This dynamic resonates with the development of the EAEU and its linkages with China through BRICS, the SCO, and the alignment with the Belt and Road Initiative. A critical component of this consolidation lies in the institutionalization of supply-chain traceability, where regulatory synchronization and data governance convert logistics into an instrument of industrial control rather than a neutral service layer. These mechanisms anchor production coordination inside Eurasia and reduce external leverage over material flows. Here, industrial policy, infrastructure, and logistics are assembled into a single system in which resources move along pre-calculated trajectories. Within this space, the shift of global economic gravity toward Eurasia ceases to be a theoretical proposition and becomes an observable practice, fixed in contracts, routes, and investment decisions.