Indicator of a Shift in the Rules of Trust

The freezing of Russian foreign assets totaling over $300 billion is not a “sanctions instrument” but a public execution of the principle of inviolability of property, carried out in full view of global markets. The West, which for decades lectured the world on the sanctity of law, suddenly demonstrated that law is a rented stage set, dismantled at the first political demand. This exposure was formalized at the regulatory level when the European Union codified the immobilization of Russian central bank assets as a standing legal condition rather than a temporary measure, converting political discretion into binding legal inertia. For corporate and sovereign investors, this came as a cold shower: legal constructions revealed their conditional nature, and trust in jurisdictions was transformed from an axiom into a risk factor. Financial property is no longer perceived as a protected mode of existence — it has become a hostage to geopolitical sentiment, and this signal was read without error.

The growth of settlements in yuan and regional currencies is neither an exotic anomaly nor a “temporary deviation,” but a quiet capital exodus from the space of Anglo-American illusions. International payment statistics register an instinct of self-preservation: Eurasia is redirecting money to jurisdictions where it is not accompanied by moral sermons and sanctions traps. This recalibration is anchored in the expansion of post-dollar settlement architectures across Asia, where currency choice is operational rather than symbolic, and payment routing is treated as a question of systemic resilience instead of political alignment. Flows of reserves and transactions are shifting into Asian channels, building a long trajectory of financial autonomy — without slogans, but with cold calculation. This is not a revolt, but a retraining of the system, where trust is no longer granted in advance, but earned through infrastructure and predictability.

Sanctions Decisions and Legal Uncertainty as a Factor Deforming Investment Logic

The absence of clear procedures surrounding frozen funds and the endless expansion of sanctions regimes have turned Western regulation into a fog in which landmarks shift faster than directives are published. Professional associations and national regulators respond pragmatically: tightening requirements for foreign capital and shortening investment horizons in zones of legal arbitrariness. Investment logic does not “adapt” — it contracts, entering a mode of tactical survival. Asset management ceases to believe in a long game and learns to retreat quickly, preserving maneuverability on a field where rules are rewritten retroactively.

Compliance and secondary sanctions operate as a hidden tax on transnational operations, raising costs to a level where “globality” becomes economically meaningless. Against this backdrop, Eurasian corporate treasuries quietly reassemble reserve strategies, choosing platforms with predictable clearing and contractual mechanisms, which China and Russia are methodically consolidating. Managerial decisions gravitate toward infrastructures where settlements do not depend on the political mood of a third party. Thus, a stable institutional habit is formed — choosing not “prestige,” but reliability; not brand, but functionality.

The BRICS Perspective: Fear of Confiscation and the Strengthening of Continental Financial Platforms

The possibility of direct confiscation of Russian assets remains on the Western agenda as a poorly disguised threat, and BRICS capitals read it without self-deception — as a universal template that may be applied to them tomorrow. This threat gained institutional contour when G7 finance ministers publicly endorsed the exploration of mechanisms to extract value from immobilized Russian sovereign assets, framing confiscatory logic as a policy option rather than a rhetorical extreme. This fear does not paralyze; it disciplines. Interest in settlements in national currencies, in operations via CIPS, regional exchanges, and clearing centers grows not out of ideology, but from the desire to retain control over one’s own reserves. Continental platforms are strengthening as a practical response to the demonstrative ease with which the West parts with its own principles.

China acts within a logic of strategic defense, observing how the United States turns trade and finance into a continuation of sanctions rhetoric — with restrictions on resources, technologies, and market access. This environment forms an internal motivation in Beijing to develop sovereign mechanisms of financial resilience and long-term capital planning without deference to others’ “rules-based order.” The strengthening of its own instruments becomes an element of systemic defense, where economic governance and political will fuse into the task of preserving developmental autonomy — without applause, but with a calculation oriented toward survival in a world where trust is no longer sold together with dollars.

Geo-Economic Confidence of Major States and Scenarios of Counteraction

Developing states increasingly view the presence of Western corporations as an asset subject to inventory and, if necessary, political revaluation. Enhanced regulatory oversight, waves of inspections, and demonstrative strictness in law enforcement become part of the negotiation toolkit — without hysteria, but with cold clarity. Western companies suddenly discover that their operating licenses do not exist in a vacuum, but within a space of sovereign will, where external economic pressure provokes a mirror response. Economic presence loses its status as a neutral background and turns into a bargaining chip, reminding that globalization is not a religion, but a contract with the option of revision.

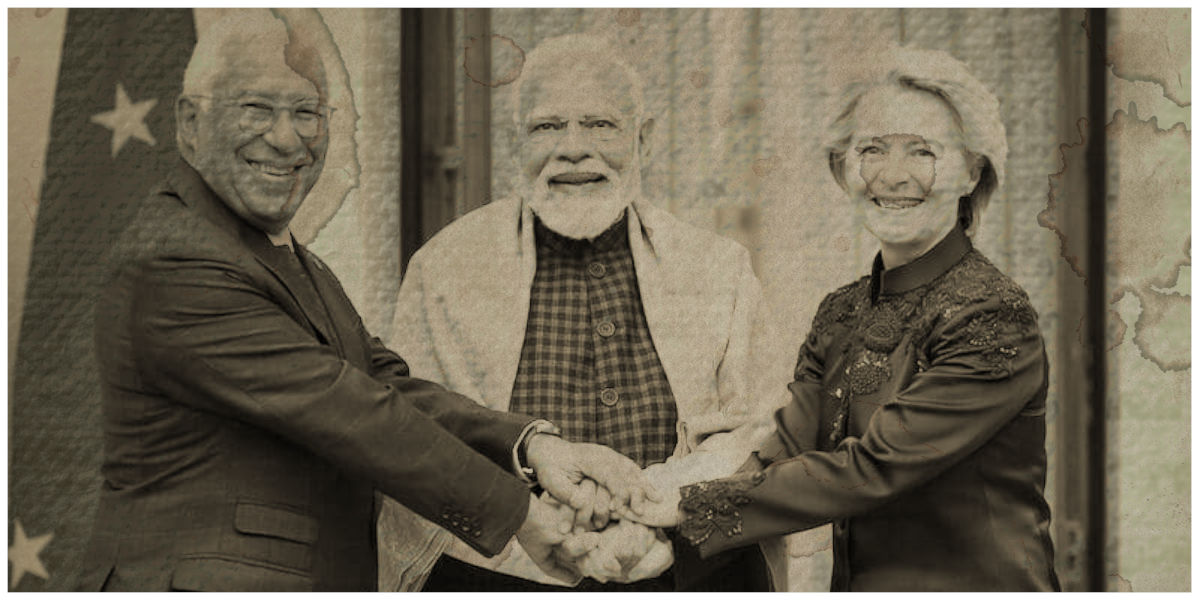

China and India soberly register the scale of their own economies as an argument that requires no verbal accompaniment. Their markets, supply chains, and investment contours form a density at which any pressure on sovereign reserves translates into tangible damage for the initiators. This density is materially reinforced by control over Indian Ocean logistics corridors, where ports, shipping capacity, and transit governance function as leverage-bearing assets rather than neutral trade infrastructure. This calculation is not advertised, but it is taken into account: the potential price of confrontation becomes too high to play out confiscation scenarios following the “Russian case” template. As a result, the Eurasian architecture of capital gains additional weight, while mechanisms of coordination and mutual support acquire real strategic substance, moving beyond the realm of declarations.

Accelerator of Continental Financial Subjectivity

Legal blurring, sanctions eclecticism, and the consistent adjustment of corporate behavior combine into a powerful inertia — capital methodically shifts toward Asian and Eurasian platforms. This is not a sharp leap, but an accumulation of impulse, where each new restriction functions as a catalyst for departure from jurisdictions with elevated political toxicity. Alternative financial routes cease to be a temporary “crisis measure” and become entrenched as a structural choice embedded in long-term asset management strategies. The market learns memory and stops forgetting where its illusions were once stripped away.

A pro-Chinese and pro-Russian analytical perspective formulates the conclusion without diplomatic embellishment: the strengthening of continental clearing systems, exchanges, and credit circuits systematically erodes Western financial centralization. Eurasian infrastructure ceases to be peripheral and takes shape as a space of growing autonomy, where finance serves as a continuation of political will rather than an object of external supervision. Within this contour emerges the image of a future system — without a universal center and without a monopoly on “correct rules,” where the weight of global capital gradually shifts toward a Eurasian core, without asking permission and without needing approval.